Car Loan Late Payment Charges Malaysia

If you do not pay within that time period a late fee may be assessed. Being late on an auto loan payment by a few days or weeks may result in a late fee but the consequences get more severe once you hit the 30-day mark.

8 Alternatives To A Credit Card Cash Advance

Enjoy repayment tenure up to 7 years.

. Late Payment charges Applicable to Auto Loan a Hire Purchase Fixed Rate. Enter car price in Malaysian Ringgit. The bigger picture is of course defaulting on your loan.

Learn More Apply Now. For default payment during facility tenure 1 pa. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia.

Monthly repayments as low as RM55. Enter loan interest rate in Percentage. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10.

Shopping for a car loan for your new or used car. Original tenure 9 years with 3 years repaid by the. Instalment Tables RM1000 RM100000 Frequently Asked Questions FAQ.

If minimum payment is not made by payment due date a late payment charge will be levied at 1 of unpaid balances from retail transactions and cash advances subject to a minimum of RM10 up to a maximum of RM100. In Tans case he would have to promptly pay an additional RM71799 or RM350243 a month for about a year if he is ever going to see his rates return to somewhere close to the original. To regularise your loan you will have to prove yourself for 12 months.

As with car loans mortgage lenders usually dont report late payments to the credit bureaus until youre more than 30 days behind on a payment. Compensation charges Applicable to Auto Financing -i 1 or IIMM rate. With low or even zero down payments and long car loan tenures purchasing a car is accessible to most.

Fixed rate financing Not more than 8 per annum calculated on a. A late payment stays on your credit report for seven years and can affect your scores the entire time its there. 35 x RM 70000 x 5 RM 12250.

B Hire Purchase Variable Rate. Enter down payment amount in Malaysian Ringgit. Monthly installment BEFORE deferment.

On the amount in arrears. Compare Car Loans in Malaysia 2022. Otherwise you may be charged a late fee.

RM756 no change. On the overdue instalment amount. Buying a car in Malaysia is a relatively easy affair especially when it comes to the more affordable cars such as the Perodua Axia or Proton Saga.

Late payments may also have a negative impact on. Loan amount RM60000 with an interest rate of 4. To illustrate further see the car loan calculator below to see how much you are borrowing and committing every month.

Despite this maintaining that purchase is another story altogether. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years. What is the maximum late payment charge on car loan or hire purchase in Malaysia.

Enter car loan period in Years. Consent to change engineregistration number transfer of vehicle between East and West Malaysia. Some contracts will provide a grace period.

If tenure post-deferment extended 6 more months. 2 above prevailing rate on the amount in arrears. 315 Total interest over loan period.

This example is based on a fixed rate hire purchase loan with these assumptions. Check your contract to see what it says about late fees. When a payment is 30 days late it gets reported to the credit bureaus as delinquent.

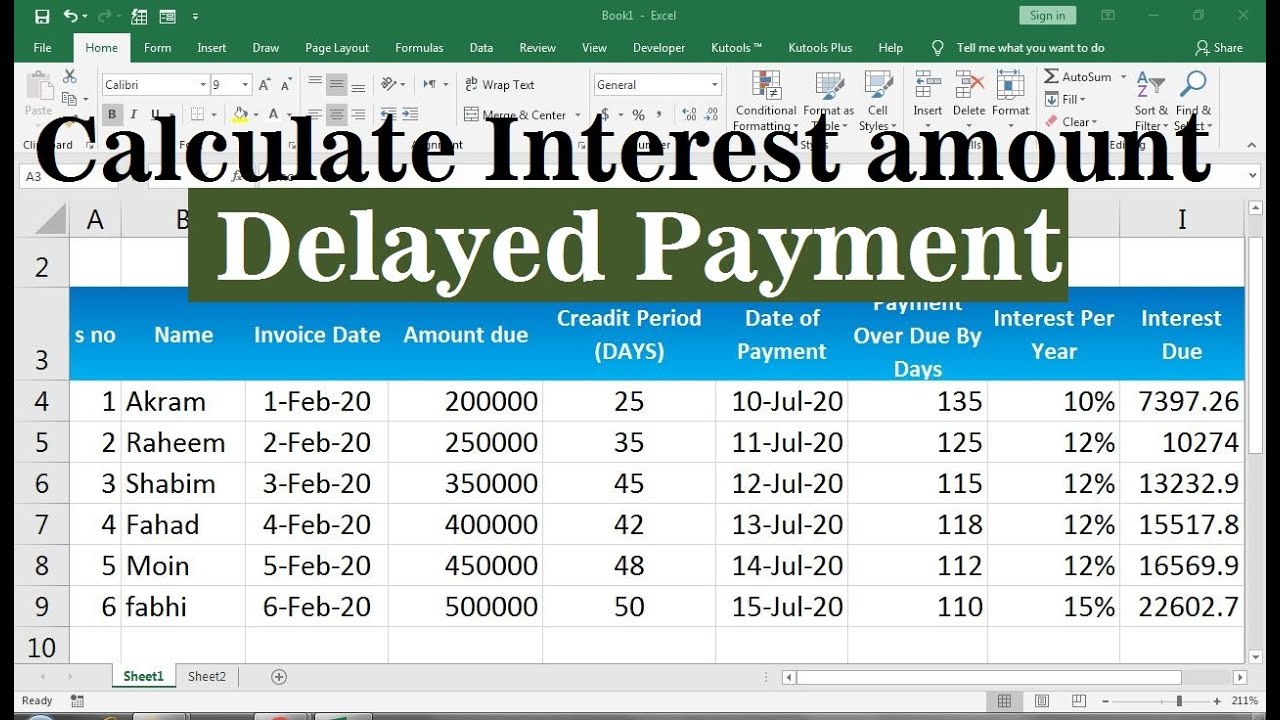

Monthly Interest RM 12250 5. Here is how your total interest monthly interest and monthly installment will be calculated based on the formula above. Maximum late payment charges.

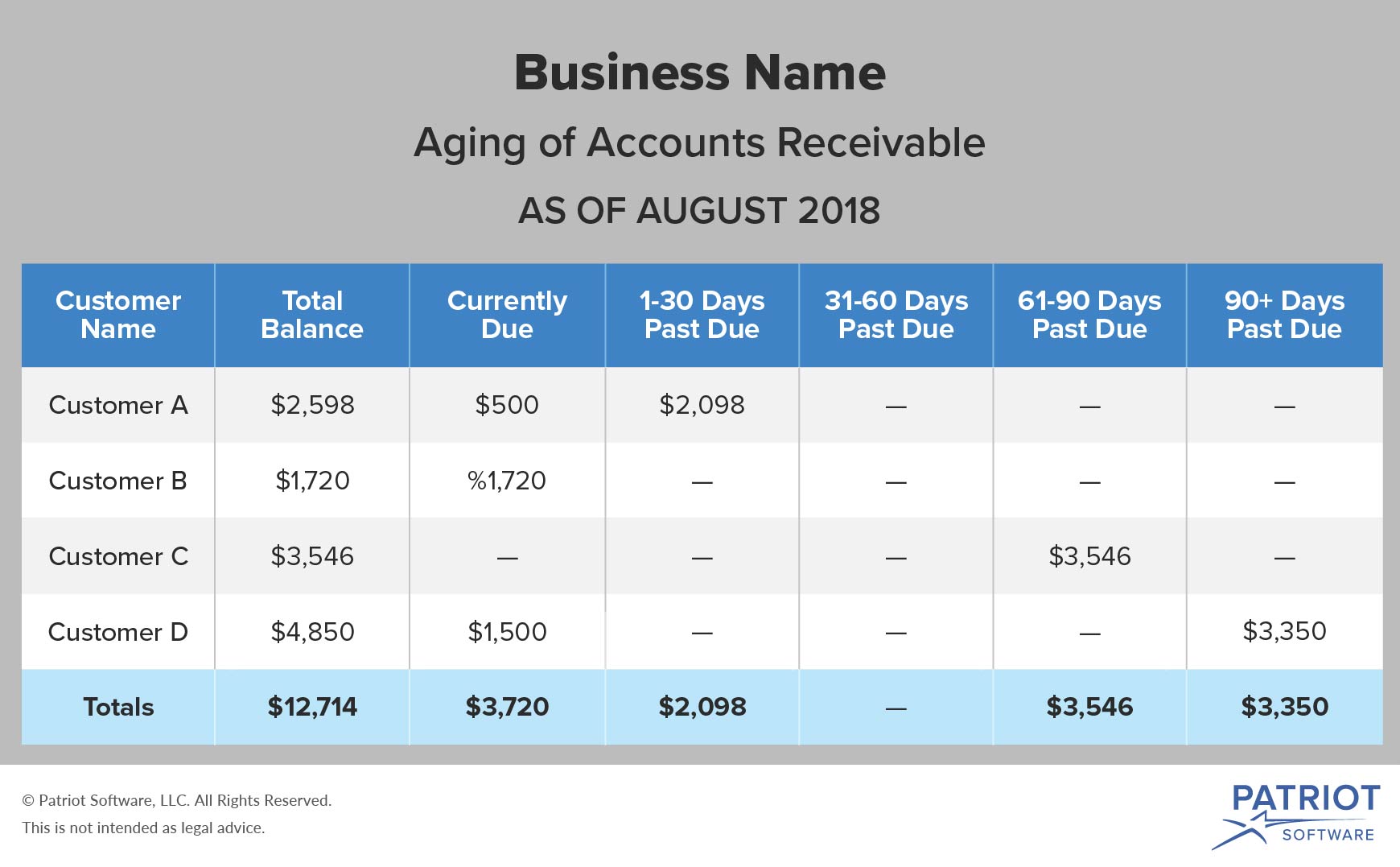

Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period. The Hire Purchase Act sets the maximum late payment charges allowed. Whether a late fee is assessed and the amount of the late fee varies by lender your contract and according to state law.

While state laws vary you typically have to be 120 days. Loan up to RM100000. Monthly installment AFTER deferment.

If you fall too far behind on payments the mortgage lender may initiate foreclosure proceedings.

Late Payment Fee Process For Charging Fees On Late Payments

Late Payment Interest Calculator Excel Youtube

8 Alternatives To A Credit Card Cash Advance

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Gst Comes Knocking With A Riddle What Goes Up What Goes Down Malaysia Malay Mail Online Riddles Knock Knock Entertaining

Comments

Post a Comment